Bboxx Kenya, a next-generation utility company has secured a KSh1.6 billion (US$15 million) loan provided by SBM Bank Kenya to provide access to clean, reliable, and affordable energy to nearly half a million people through off-grid solar home systems (SHS) in Kenya.

GuarantCo, a part of the Private Infrastructure Development Group (PIDG), has provided a KSh1.2 billion (US$11.25 million) partial guarantee (75 per cent) against the loan facility.

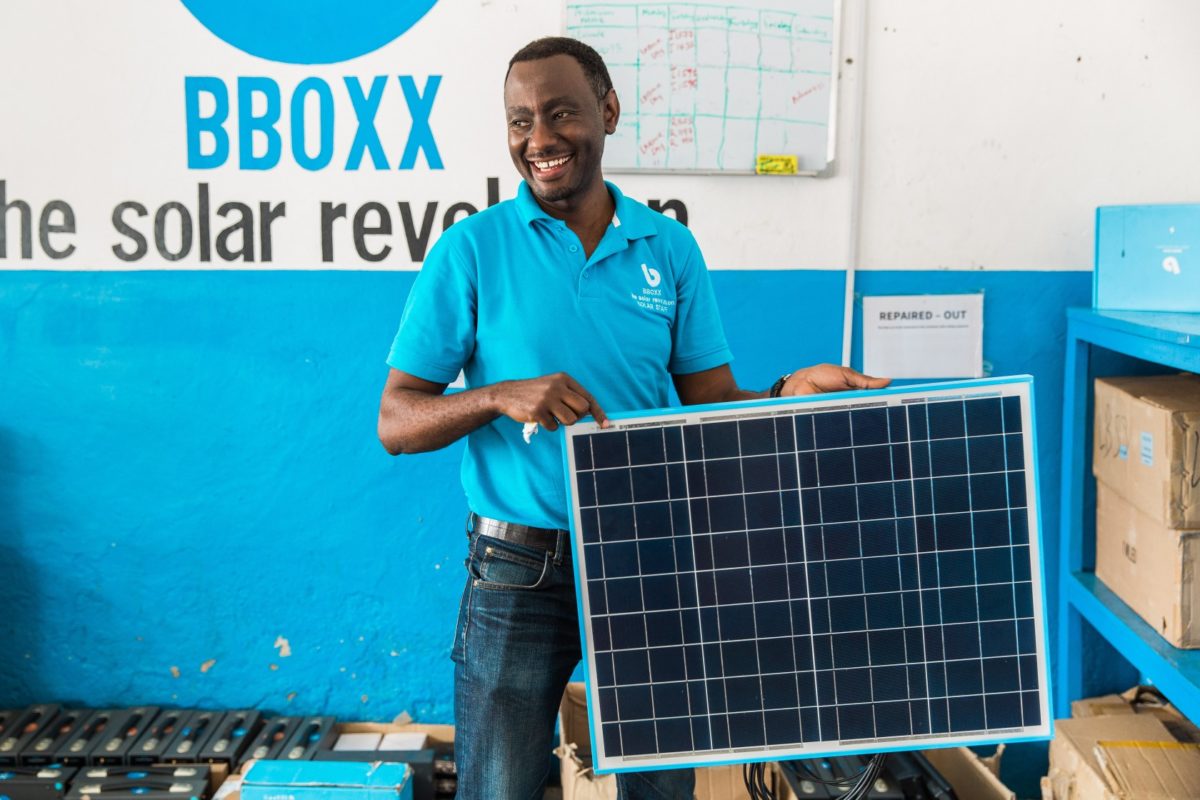

The funds will be used by Bboxx Kenya to purchase new inventory over the next two years including 89,600 solar home systems and essential appliances such as fridges and phones.

These are expected to serve 470,000 people, 80 per cent of whom are based in rural areas and the majority of whom currently use torches and non-traditional fuel, such as wood and kerosene, as their main source of lighting.

The guarantee will support Kenya’s broader push towards electrification. Kenya’s electrification rate is estimated at around 70 per cent though there is some disparity between urban (90 per cent) and rural areas (60 per cent).

The Kenya National Electrification Strategy, developed in 2018, demonstrates the Government of Kenya’s commitment to scaling up off-grid electrification with ambitions to establish two million new connections by 2022, notably through solar home systems and mini-grids.

The transaction will contribute to United Nations’ Sustainable Development Goals: Affordable and Clean Energy (SDG 7) and Climate Mitigation (SDG 13) through increasing access to affordable and reliable energy.

At present, Bboxx Kenya employs 350 workers, 40 per cent of which are women, and the company intends to maintain this proportion of female employment as the workforce as it grows. The transaction will enable the creation of a further hundred new long-term jobs with efforts to provide opportunities for women in the process.

Historically investments on the African continent in the off-grid SHS sector have been made in hard currency, which can expose companies to significant exchange risks. Through mobilising a local bank, the guarantee will match the currency of funding needs with operations and collections and so contribute to the overall sustainability of the business.

This is expected to have wider market benefits through demonstrating a model for domestic banks and increasing their appetite to lend to the sector.

Mansoor Hamayun, CEO of Bboxx, said: “We are very pleased to partner with GuarantCo and SBM Bank to accelerate access to clean, reliable, and affordable energy to hundreds of thousands of Kenyans.”

Jeff Vanden Berghe, Managing Director Bboxx Kenya, said: “Over the past 12 months we have been working closely with GuarantCo and SBM to bring this partnership to fruition. This marks Bboxx Kenya’s first local currency transaction, which allows us to bring more renewable, low-cost and safe energy to an extra 470,000 Kenyans.”

Commenting on the tripartite transaction arrangement, Jotham Mutoka, Deputy Chief Executive Officer (DCEO) SBM Bank Kenya’s said: “SBM Bank is elated to spur the growth of the energy sector in Kenya through partnerships with like-minded entities such as Bboxx and GuarantCo.”

Mr Mutoka disclosed that the SBM Bank is keen to work towards achieving the sustainable development goals of the UN on access to clean energy.

“We continue to work with our customers in key sectors of the economy like energy, manufacturing, Agribusiness to offer unique and tailor-made solutions that meet their needs whether they are SMEs or large corporates. The Bank is keen working to offer sustainable finance, especially the renewable energy space to its clients,” concluded Mr Mutoka.